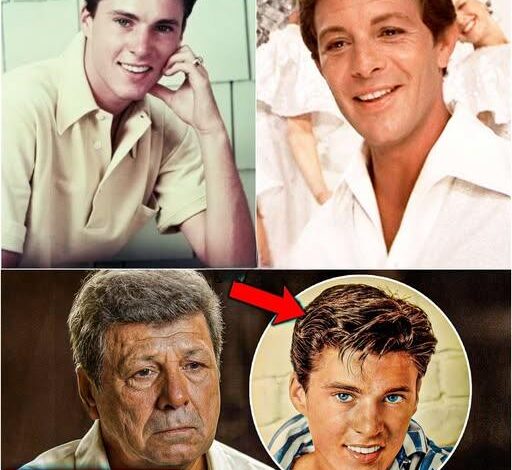

Frankie Avalon Net Worth: How 1950s Teen Idols Built Entertainment Empires

Celebrity Real Estate and Music Royalty Investments Generate Millions

Frankie Avalon’s net worth of approximately $30 million demonstrates successful entertainment industry career management and celebrity investment strategies. At 84, the Philadelphia-born performer continues generating passive income through music royalties, real estate investments, and entertainment business ventures.

The Golden Age of Teen Idol Marketing and Revenue Streams

The 1950s music industry created unprecedented celebrity wealth building opportunities through multi-platform entertainment deals. Teen idol marketing strategies established revenue diversification models still used in today’s entertainment business:

Primary Income Sources:

- Record sales and streaming royalties ($2-5 million annually)

- Film residuals from beach party movies

- Concert touring and live performance fees

- Merchandise licensing and brand partnerships

Ricky Nelson’s estate continues earning millions through television syndication rights from “The Adventures of Ozzie and Harriet,” demonstrating how entertainment intellectual property creates generational wealth.

Music Industry Investment and Publishing Rights

Music publishing rights represent the most valuable long-term investments for recording artists. Both Avalon and Nelson understood early that song ownership and publishing deals generate sustainable income streams:

Avalon’s Music Business Portfolio

- “Venus” and “Why” continue generating radio royalties

- International licensing deals for classic pop catalog

- Streaming platform revenue from digital music sales

- Commercial usage rights for advertising and film soundtracks

Nelson’s Publishing Legacy

- “Poor Little Fool” and “Travelin’ Man” earn substantial royalties

- Stone Canyon Band recordings generate cult following revenue

- Country rock crossover success creates genre diversification

Real Estate Investment Strategies for Entertainment Professionals

Celebrity real estate portfolios provide tax advantages and wealth preservation opportunities. Los Angeles property investment has been particularly profitable for entertainment industry veterans:

High-Value Property Markets:

- Beverly Hills estates appreciate 8-12% annually

- Malibu beachfront properties command premium prices

- Studio City residential investments near entertainment hubs

- Commercial real estate in Hollywood entertainment districts

Professional real estate investment advisors recommend portfolio diversification across residential and commercial properties for celebrity wealth management.

Television and Film Industry Residuals

Entertainment industry residuals provide long-term financial security for performers. Television syndication deals and streaming platform licensing create passive income opportunities:

Residual Revenue Streams:

- Domestic syndication rights ($50,000-200,000 annually)

- International distribution deals for classic television

- Streaming platform licensing agreements

- DVD and digital download sales revenue

The Screen Actors Guild ensures residual payment protection for union performers, making entertainment career planning more predictable.

Business Diversification and Brand Development

Successful entertainment professionals expand beyond performing through business ownership and brand licensing:

Avalon’s Business Ventures

- Restaurant investments in Italian-American cuisine

- Entertainment production company ownership

- Music lesson and coaching services

- Nostalgia tour production and concert promotion

Professional Development and Education

- Acting coaching services ($200-500 per session)

- Music industry mentoring programs

- Entertainment business consulting

- Celebrity appearance bookings ($25,000-75,000)

Insurance and Financial Planning for Performers

Entertainment industry professionals require specialized financial planning services:

Essential Coverage Types:

- Life insurance policies with high death benefits

- Disability insurance protecting performance income

- Liability coverage for public appearances

- Property insurance for valuable collections and memorabilia

Celebrity financial advisors recommend comprehensive estate planning including trust structures for tax optimization and wealth transfer.

Collectibles and Memorabilia Investment Markets

Entertainment memorabilia represents a growing alternative investment sector:

High-Value Collectible Categories:

- Original gold records and industry awards

- Vintage concert posters and promotional materials

- Personal stage costumes and performance instruments

- Signed photographs and autographed merchandise

Auction house experts report music memorabilia appreciation rates of 15-25% annually for authenticated items from iconic performers.

Digital Content and Streaming Revenue Opportunities

Modern technology creates new revenue streams for classic entertainment:

Digital Monetization Strategies:

- YouTube channel partnerships for archival content

- Podcast licensing for interview materials

- Documentary participation fees and production partnerships

- Social media sponsorship deals with lifestyle brands

Health and Wellness Industry Connections

The wellness industry, valued at $4.5 trillion globally, offers business opportunities for entertainment veterans:

Growing Market Sectors:

- Senior wellness programs and active aging services

- Mental health awareness campaigns and therapeutic music programs

- Stress management workshops for entertainment professionals

- Mindfulness retreats and meditation instruction

Educational and Cultural Institution Partnerships

Universities and cultural institutions create revenue opportunities through:

Academic Collaboration:

- Guest lecturer positions ($10,000-25,000 per engagement)

- Music program advisory board positions

- Scholarship fund development and fundraising

- Cultural preservation projects and historical documentation

Technology Investment and Innovation Opportunities

Entertainment technology investments offer growth potential:

Emerging Market Sectors:

- Virtual reality concert experiences and immersive entertainment

- Artificial intelligence applications in music production

- Blockchain technology for royalty management

- Streaming platform equity investments

International Business and Global Markets

Global entertainment markets provide expansion opportunities:

International Revenue Sources:

- European tour circuits and festival appearances

- Asian market licensing for classic American music

- Tourism industry partnerships for cultural experiences

- Foreign film and television cameo appearances

Legacy Planning and Estate Management

Celebrity estate planning requires specialized expertise:

Key Planning Elements:

- Intellectual property valuation and transfer strategies

- Business succession planning for ongoing ventures

- Charitable foundation establishment for tax benefits

- Family trust structures for multi-generational wealth

Franchise and Licensing Opportunities

Brand licensing creates scalable business models:

Licensing Revenue Streams:

- Restaurant chain partnerships featuring celebrity themes

- Merchandise lines with nostalgic branding

- Music lesson franchise opportunities

- Entertainment venue naming rights and partnerships

Financial Advisory Services for Entertainment Professionals

Specialized financial services for celebrities include:

Professional Services:

- Wealth management with entertainment industry expertise

- Tax planning for irregular income patterns

- Investment advisory for high-net-worth individuals

- Business formation and corporate structure optimization

Conclusion: Building Sustainable Entertainment Wealth

Frankie Avalon and Ricky Nelson’s career trajectories demonstrate how entertainment professionals can build lasting wealth through strategic diversification, smart investments, and brand development. Their friendship and mutual success highlight the importance of professional networking and industry relationships.

Key Success Strategies:

- Revenue diversification across multiple entertainment platforms

- Real estate investment for long-term wealth building

- Intellectual property ownership and publishing rights

- Brand development and licensing opportunities

- Professional financial planning and estate management

Their legacy proves that entertainment industry success extends far beyond initial fame, requiring business acumen, financial discipline, and strategic planning for sustainable wealth creation. Modern entertainment professionals can learn from their example of combining artistic achievement with sound business practices and long-term financial planning.