From High-Profile Marriage to Rural Wellness: A Celebrity’s Journey to Financial Independence

Celebrity Life Transformation: When Fame Meets Financial Planning

A prominent figure once associated with luxury events and high-society gatherings made a surprising life choice that would define her next decades. After her widely publicized marriage dissolution, she embraced rural living, focusing on raising her daughter while building long-term financial security. Now in her 60s, she continues to prioritize wellness and smart investment strategies over the extravagant lifestyle she once knew.

Early Career and Entertainment Industry Beginnings

Her journey began in New York, where she participated in beauty competitions and pursued opportunities in the entertainment sector. While establishing her career foundation, she was still developing her professional identity in the competitive city environment. During this pivotal period, she encountered a prominent businessman who was already generating significant media attention.

Their relationship quickly became a focal point for entertainment media, elevating her profile to national prominence. The intense public scrutiny that followed became a defining factor in her life trajectory, transforming her into a media personality and influencing her future financial decisions.

High-Profile Romance and Strategic Marriage Planning

The relationship began on Madison Avenue during a period when the businessman’s previous marriage was experiencing difficulties. Their romance became a media phenomenon, with publications highlighting the contrasts between her and his former spouse.

While his ex-wife represented polished European business acumen, she embodied Southern charm and beauty pageant experience, openly discussing her spiritual beliefs that combined traditional Christian faith with contemporary New Age practices.

Family Planning and Investment Considerations

In 1993, she welcomed her daughter Tiffany, marking a significant milestone in both her personal life and financial planning journey. The businessman faced pressure from his conservative family regarding having a child outside marriage, while simultaneously preparing to take his struggling casino businesses public.

His high-profile relationship had already attracted negative investor attention, and marriage was viewed as a strategic move to stabilize both his personal reputation and business prospects. The decision to marry involved careful consideration of both emotional and financial implications.

Prenuptial Agreements and Financial Protection Strategies

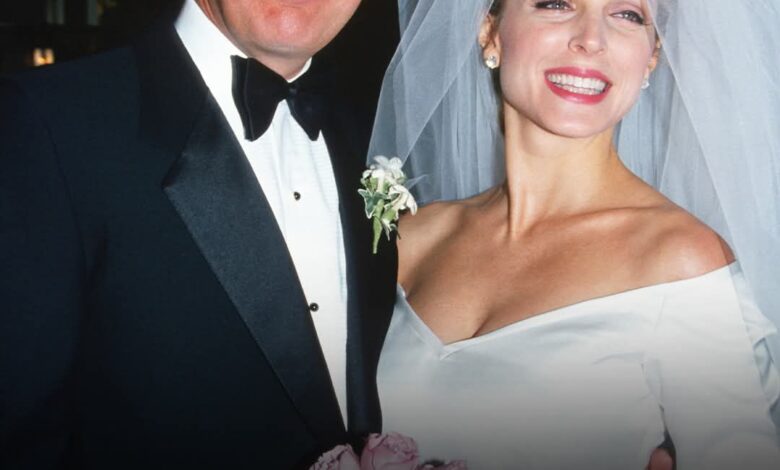

Before their December 1993 wedding ceremony at the prestigious Plaza Hotel in New York City, comprehensive prenuptial agreements were established to protect both parties’ financial interests. These legal documents would prove crucial in defining the terms of their eventual separation.

Her transformation from high-profile celebrity to rural wellness advocate demonstrates that financial independence is achievable through strategic planning, smart investments, and lifestyle choices aligned with personal values. By prioritizing her daughter’s wellbeing while building long-term wealth, she created a sustainable model for success that others can emulate.

Key takeaways for financial success include:

- Developing comprehensive prenuptial agreements for asset protection

- Diversifying investment portfolios across multiple sectors

- Embracing technology for efficient financial management

- Prioritizing wellness investments for long-term growth

- Creating multiple income streams for financial stability

Whether you’re planning for marriage, divorce, or simply building wealth for the future, professional financial planning services can help you achieve your goals while protecting your assets.