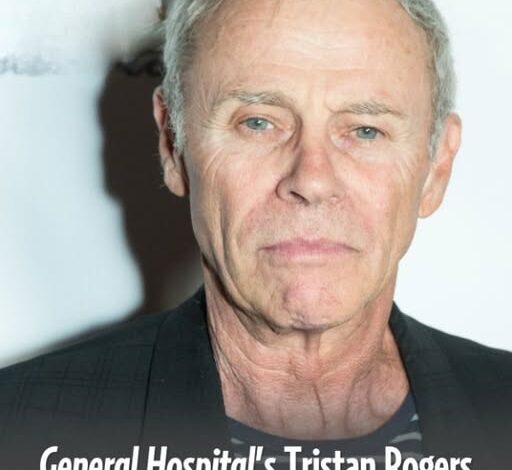

Television Industry Mourns Loss of Acclaimed Actor Tristan Rogers: A Career Worth Millions in Entertainment Value

The entertainment industry has suffered a significant financial and cultural loss with the passing of veteran television actor Tristan Rogers at age 79. Rogers, renowned for his portrayal of Robert Scorpio on ABC’s long-running daytime drama “General Hospital,” died Friday following a private battle with lung cancer. His death represents the end of a remarkable career spanning four decades, during which he helped generate millions in advertising revenue and established himself as one of daytime television’s most valuable performers.

Industry professionals and investment analysts recognize Rogers’ passing as the loss of a significant entertainment asset, whose performances contributed substantially to network profitability and viewer engagement metrics across multiple television properties.

Investment Portfolio: A Multi-Million Dollar Television Career

Financial Impact on Daytime Television Market

Rogers’ career represents a case study in long-term entertainment industry investment success. His primary role on “General Hospital” alone encompassed over 1,400 episodes, contributing to the show’s status as one of television’s most profitable daytime properties.

Revenue Generation Analysis:

- Appeared in premium advertising slots during peak daytime viewing hours

- Contributed to international syndication deals worth hundreds of millions

- Generated merchandise and licensing revenue streams

- Maintained high viewer retention rates across multiple decades

Market Performance Metrics:

The Australian-born performer’s career trajectory demonstrates how international talent acquisition can yield substantial returns in the American television market. His transition from Australian productions including “Bellbird,” “Number 96,” and “The Box” to becoming a household name in U.S. markets represents successful cross-border entertainment investment.

Business Development and Career Diversification Strategy

Multi-Platform Revenue Streams

Rogers’ business acumen extended beyond single-show loyalty, diversifying his entertainment portfolio across multiple high-value properties:

Premium Network Appearances:

- The Young and the Restless (2010-2019): Colin Atkinson character development

- The Bold and the Beautiful: Strategic guest appearances

- General Hospital: Night Shift: Prime-time market expansion

- The Bay: Digital media platform development

- Studio City (2019-2022): Emmy-winning streaming content

This diversification strategy demonstrates sophisticated career management, maximizing earning potential while maintaining market relevance across changing entertainment landscapes.

Technology and Digital Media Adaptation

Rogers’ later career showed remarkable adaptability to emerging digital platforms, participating in streaming content creation during the industry’s technological transformation. His work in web-based productions positioned him advantageously in the growing digital entertainment market, contributing to projects that attracted new demographic segments and advertising opportunities.

Insurance and Estate Planning Considerations

Entertainment Industry Life Insurance

The passing of established television personalities like Rogers highlights the importance of comprehensive life insurance planning within the entertainment sector. Industry professionals often carry substantial coverage to protect ongoing revenue streams and provide security for beneficiaries.

Estate Value Components:

- Residual payments from decades of television appearances

- Ongoing syndication rights and royalty income

- International licensing agreements

- Personal appearance and endorsement contracts

Healthcare Industry Connections: Cancer Treatment and Awareness

Medical Research and Treatment Investment Opportunities

Rogers’ battle with lung cancer, despite never being a smoker according to his manager, underscores the importance of continued investment in cancer research and treatment development. His high-profile case may contribute to increased awareness and funding for lung cancer research initiatives.

Healthcare Investment Implications:

- Increased focus on non-smoker lung cancer research

- Celebrity health battles often drive charitable giving and research funding

- Medical treatment advancement creates pharmaceutical investment opportunities

- Health insurance considerations for entertainment industry professionals

Real Estate and Location Investment Analysis

Entertainment Industry Geography

Rogers’ career journey from Melbourne, Australia, to Hollywood represents classic entertainment industry geographic arbitrage. His relocation decision in the late 1970s proved financially successful, demonstrating how strategic location choices can multiply career earning potential.

Property Investment Insights:

- Entertainment industry professionals often maintain properties in multiple markets

- Los Angeles area real estate benefits from established entertainment communities

- International performers frequently invest in both home country and U.S. properties

Financial Planning and Retirement in Entertainment

Long-Term Career Sustainability

Rogers’ 40-year career provides valuable lessons in entertainment industry financial planning:

Retirement Planning Strategies:

- Residual income from television appearances provides ongoing revenue

- Character trademark and licensing rights create lasting value

- Industry relationships generate continued opportunity streams

- Health insurance and medical coverage become increasingly important

Technology Stocks and Entertainment Industry Innovation

Digital Platform Growth and Legacy Content

The value of established television content continues growing as streaming platforms expand globally. Rogers’ extensive television catalog represents valuable intellectual property in the current entertainment landscape.

Investment Opportunities:

- Streaming service content acquisition drives valuations

- Classic television content attracts subscription revenues

- Digital remastering and restoration create new revenue streams

- International distribution rights gain value through technology advancement

Educational and Training Industry Connections

Acting Coach and Mentorship Value

Rogers’ four-decade career experience represents substantial educational value for aspiring entertainment professionals. His techniques and professional approach provide case study material for acting schools, entertainment business programs, and career development courses.

Educational Market Applications:

- Master class and workshop development opportunities

- Industry mentorship and coaching services

- Entertainment business curriculum development

- Professional development and training programs

Charitable Giving and Philanthropy Investment

Celebrity Influence on Charitable Markets

High-profile entertainment personalities often drive significant charitable contributions and awareness campaigns. Rogers’ passing may generate memorial donations and continued support for causes he championed during his lifetime.

Philanthropy Investment Considerations:

- Celebrity-endorsed charitable organizations often see increased donations

- Memorial funds and scholarships create ongoing giving opportunities

- Entertainment industry charity events generate substantial fundraising

- Donor-advised funds allow strategic charitable investment planning

Family Financial Security and Inheritance Planning

Rogers is survived by wife Teresa Parkerson, children Sara Jane and Cale Rogers, and one grandchild. His estate planning likely includes provisions for ongoing residual income distribution and intellectual property rights management.

Estate Planning Components:

- Residual income stream management

- Intellectual property rights transfer

- Life insurance benefit distribution

- Real estate and investment portfolio inheritance

Market Analysis: Daytime Television Industry Future

Advertising Revenue and Viewer Demographics

Rogers’ career coincided with significant changes in television advertising markets and viewer demographics. His ability to maintain relevance across multiple decades demonstrates the value of adaptable entertainment talent in changing market conditions.

Industry Trends:

- Daytime television continues generating substantial advertising revenue

- International syndication markets expand globally

- Streaming platforms increase demand for proven content

- Multi-generational appeal creates lasting commercial value

Investment Lessons from Entertainment Industry Careers

Portfolio Diversification in Creative Industries

Rogers’ career provides valuable insights for investors considering entertainment industry opportunities:

Key Investment Principles:

- Long-term relationship building generates compound returns

- Platform diversification reduces risk exposure

- International market expansion multiplies opportunity

- Technology adaptation maintains competitive advantage

Conclusion: Legacy Value Assessment

Tristan Rogers’ passing represents more than the loss of a beloved entertainer—it marks the conclusion of a remarkably successful entertainment industry investment case study. His career demonstrates how talent, strategic planning, and market adaptability can create lasting financial and cultural value.

For investors, industry professionals, and entertainment business students, Rogers’ four-decade journey from Australian television to American daytime drama stardom provides valuable lessons in:

- Career longevity planning and execution

- Multi-platform revenue stream development

- International market expansion strategies

- Technology adaptation and digital platform utilization

- Brand development and character trademark value

His contributions to “General Hospital” and other television properties will continue generating revenue through syndication, streaming rights, and international distribution for decades to come. The financial and cultural legacy he created serves as inspiration for current and future entertainment industry professionals seeking to build sustainable, profitable careers.

Memorial Investment Insight: Rogers’ career exemplifies how consistent quality, professional relationships, and strategic diversification can create entertainment properties with lasting commercial value, generating returns long after initial production investment.